The 2024 housing market started on a positive note: inventory was on the rise, mortgage rates had fallen from a 23-year high of 7.79% in October 2023 to the mid 6% range, and home buyers had returned to the market, with U.S. existing-home sales posting back-to-back monthly increases for the first time in more than two years in January and February. But rates soon began to climb, topping 7% in April, and buyers pulled back, causing sales to slump during the traditionally busy spring buying season.

Summer arrived, and with it came a surge of new listings, pushing inventory to its highest level since 2020, according to the National Association of REALTORS®. Although buyers had more options to choose from in their home search, the additional supply did little to temper home prices, which continued to hit record highs nationwide, and sales remained slow. Eventually, mortgage rates began to ease, falling to a yearly low of 6.08% in September, and with inflation moving toward its 2% target, the Federal Reserve initiated a series of interest rate cuts, dropping the benchmark rate one full percentage point. Buyers took advantage of lower borrowing costs and a greater supply of homes on the market, leading sales of existing homes to surge in October and November, marking the first time since May that home sales exceeded four million units.

Sales: Pending sales decreased 2.6 percent, finishing 2024 at 5,084. Closed sales were down 2.5 percent to end the year at 5,281.

Listings: Comparing 2024 to the prior year, the number of homes available for sale was up by 27.7 percent. There were 1,738 active listings at the end of 2024. New listings increased by 2.5 percent to finish the year at 6,637.

Prices: Home prices were up compared to last year. The overall median sales price increased 5.4 percent to $545,664. for the year. Detached home prices were up 8.2 percent compared to last year, and attached home prices were up 3.7 percent.

List Price Received: Sellers received, on average, 97.9 percent of their original list price at sale, a year-over-year decrease of 0.2 percent.

Economists are projecting a more active housing market in 2025. Existing-home sales are predicted to increase, as are home prices, albeit at a moderate pace. Mortgage rates will vary throughout the year but will likely stay within the 6% -7% range. Buyers and sellers remain sensitive to fluctuations in mortgage rates, and the trajectory of rates will have a major impact on market activity. Inventory of new and existing homes will continue to improve in the new year, building on the supply gains made in 2024, with increases in both single-family and multifamily construction expected, according to the National Association of Home Builders.

2024 Year-End Market Report – Hilton Head Area REALTORS®

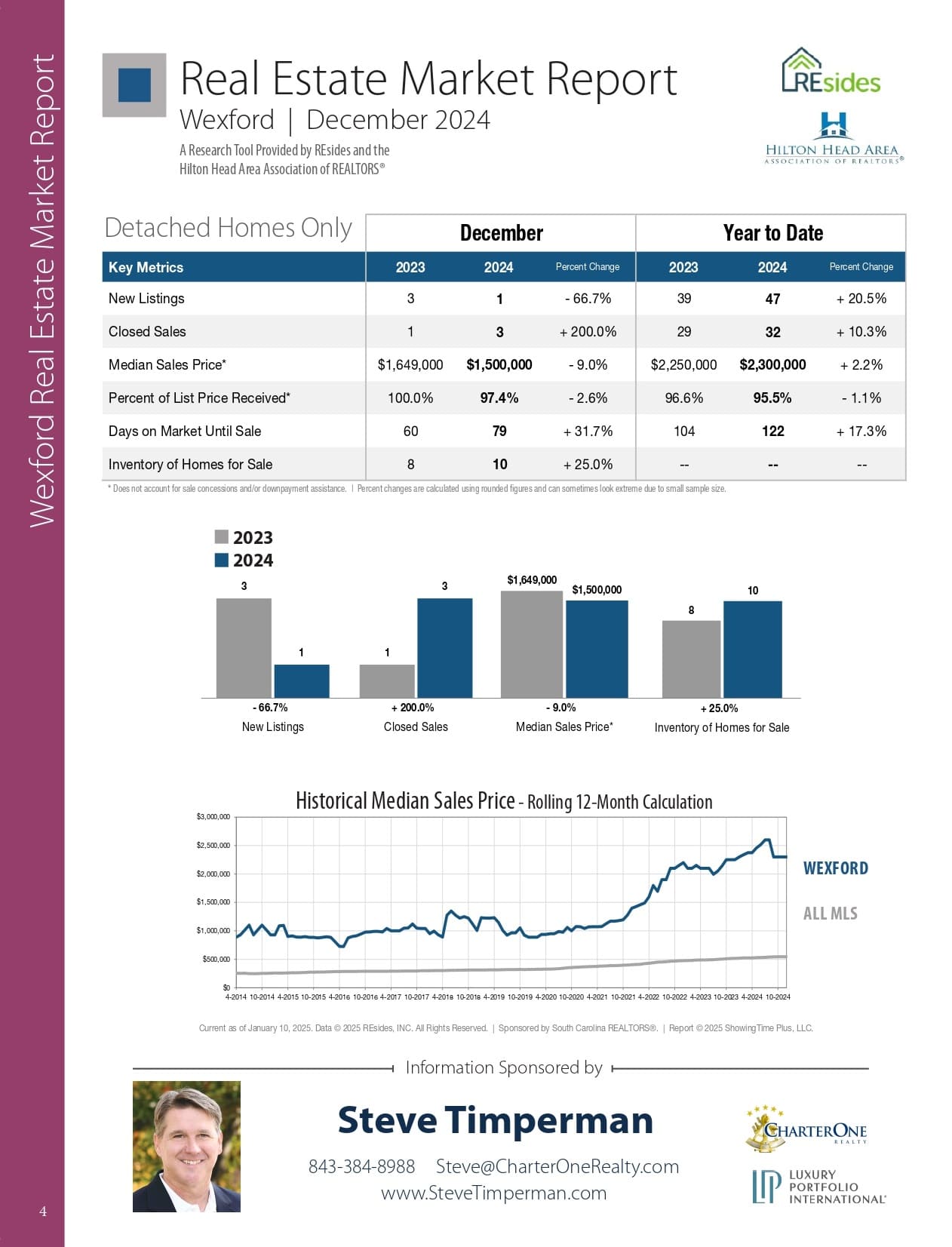

1. Wexford Real Estate Market Report

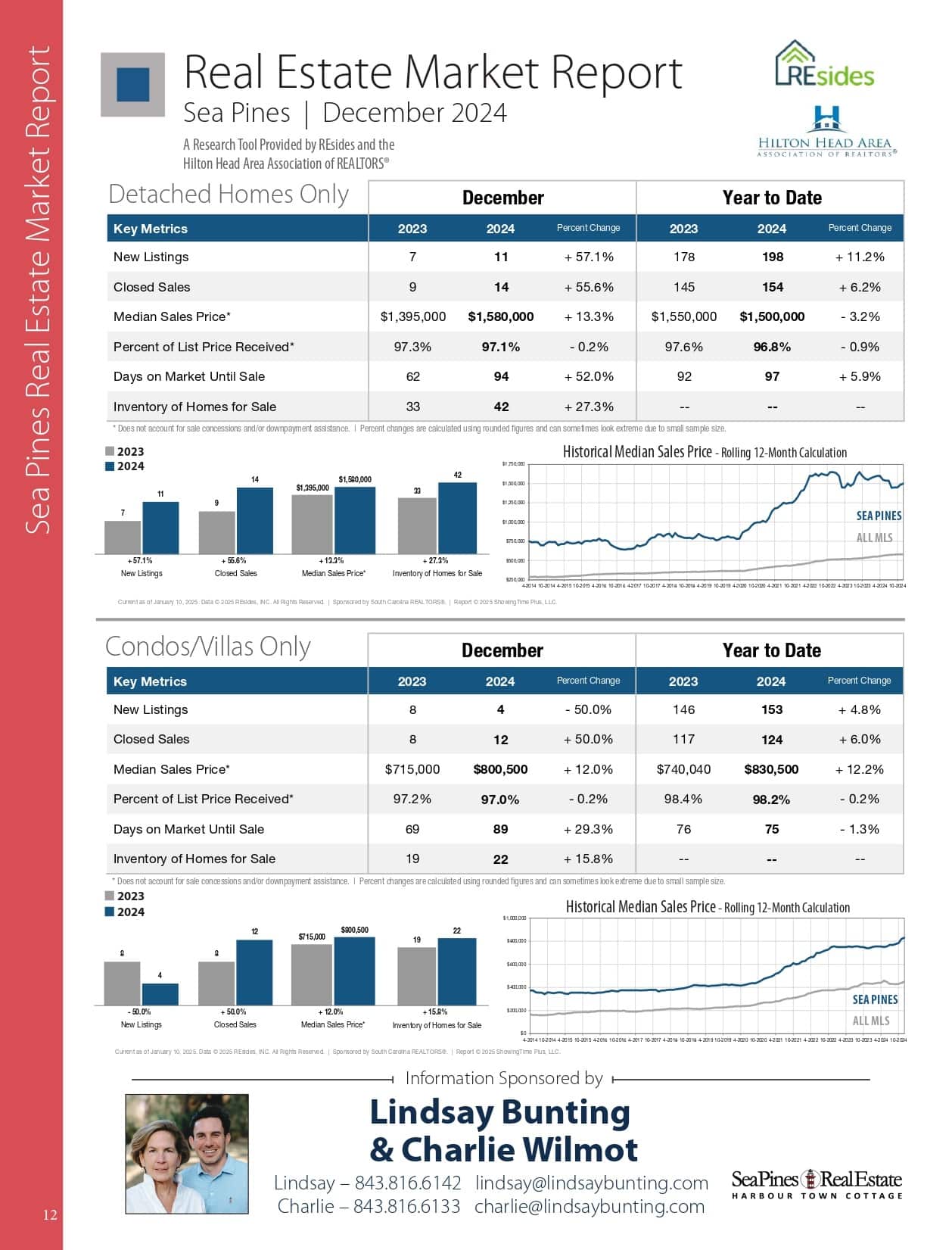

2. Sea Pines Real Estate Report

Wexford Real Estate Market Report

Sea Pines Real Estate Report

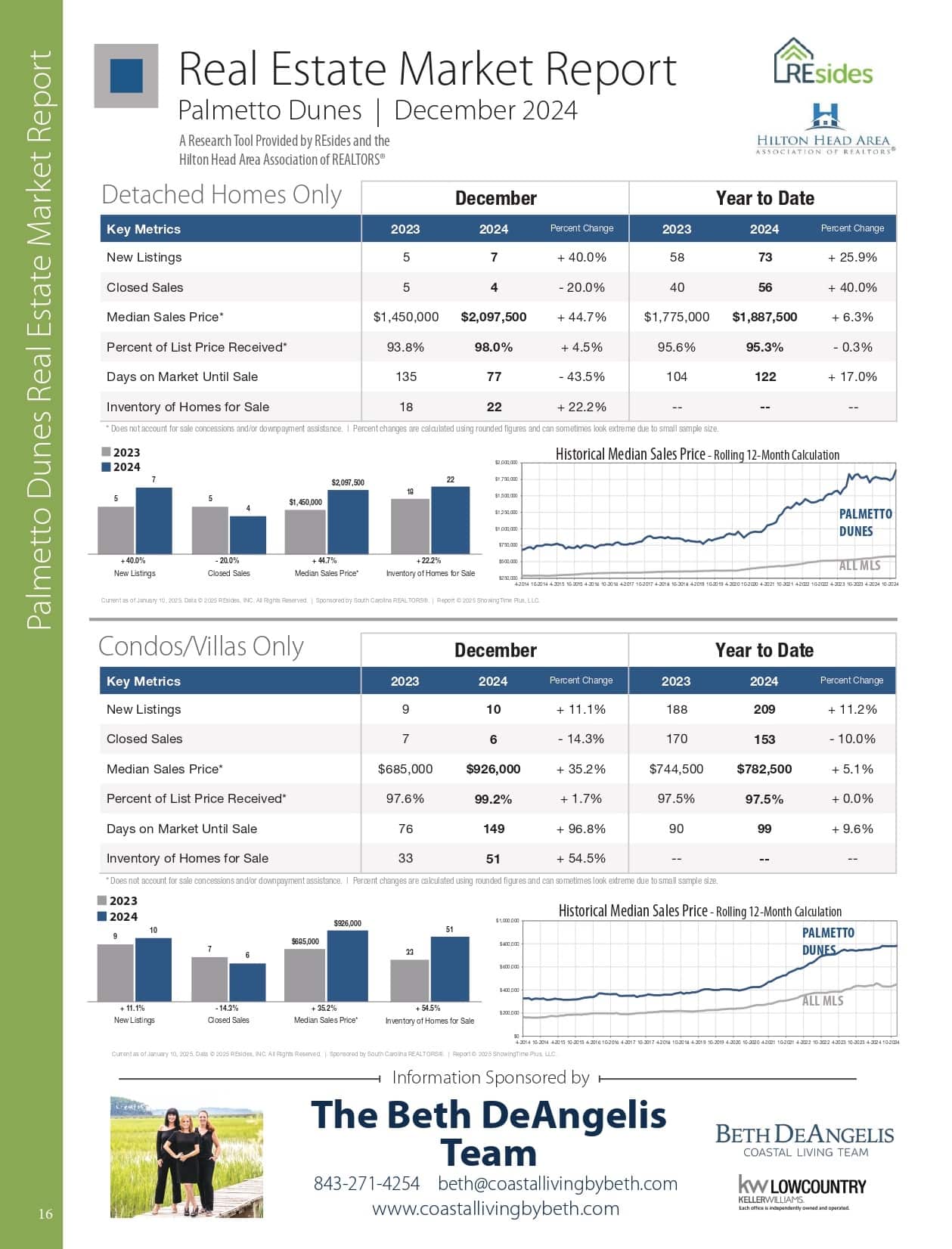

Palmetto Dunes Real Estate Report

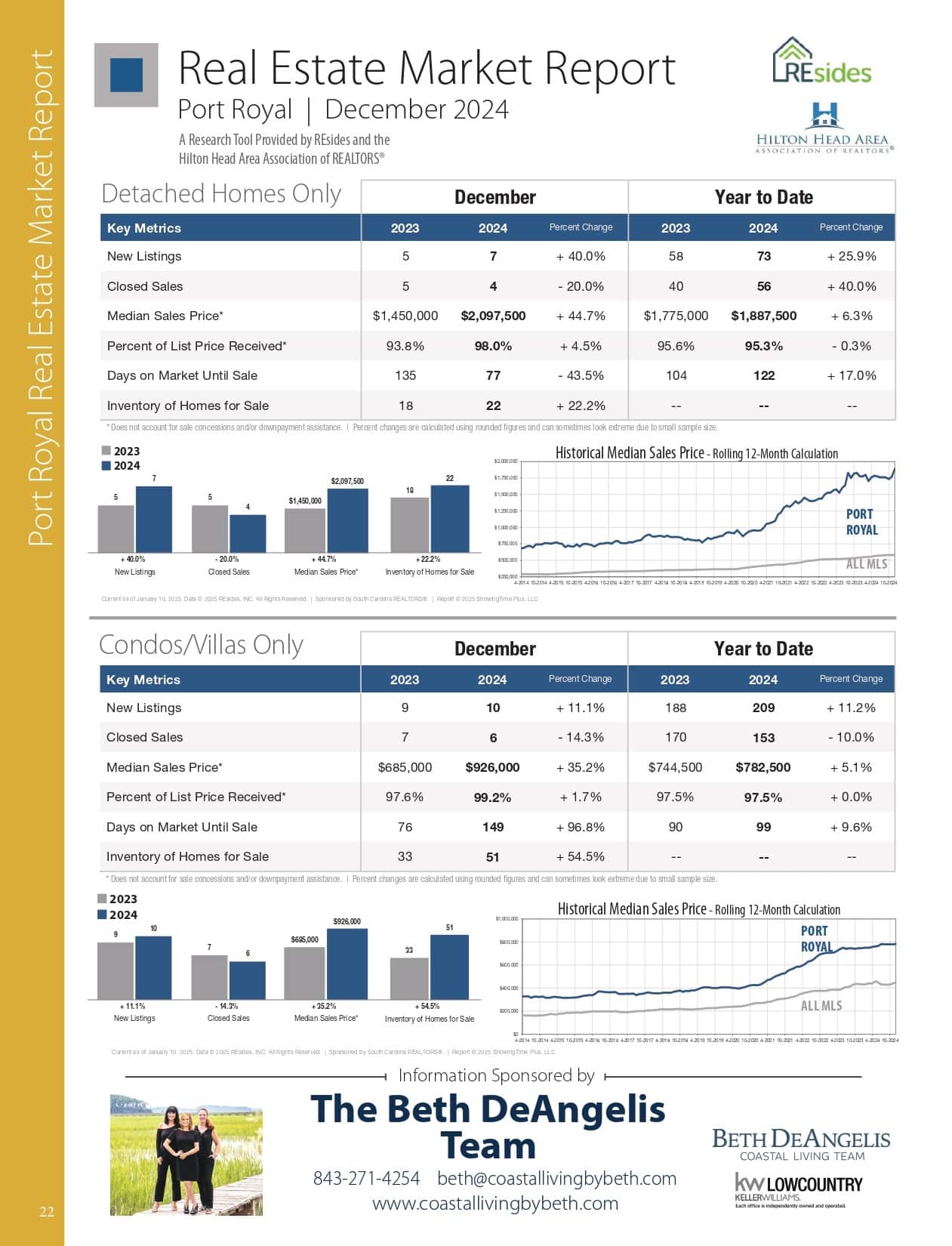

Port Royal Real Estate Market Report