It may surprise you to learn that reverse mortgages have been available since 1961. The formal name of this program is a Home Equity Conversion Mortgage or HECM.

Individuals 62 years of age or older can use a reverse mortgage to access the equity in their current home or even purchase a new home without having ongoing mortgage payments. Reverse borrowers are only required to maintain the home and pay the taxes, insurance, and any homeowners association fees as they come due. There is no requirement to repay the loan until the borrower no longer occupies the home. Funds can be taken in a combination of ways. Options include a lump sum at closing, a line of credit which can be accessed when need, or an annuity payment.

One of the most beneficial features of a reverse mortgage is that they are “non-recourse” – the homeowner does not have to pay back any balance if it is more than the value of the home. HUD insures these loans and makes this feature possible. I am not aware of any other mortgage related product available today that can offer this feature.

In conclusion, reverse mortgages can be a perfect vehicle for seniors to protect against outliving their assets and can allow them to remain in their homes indefinitely. If you are seriously considering a reverse mortgage, I urge you to meet with a qualified mortgage professional who will explain all the fees and terms in detail so that you can make an informed decision.

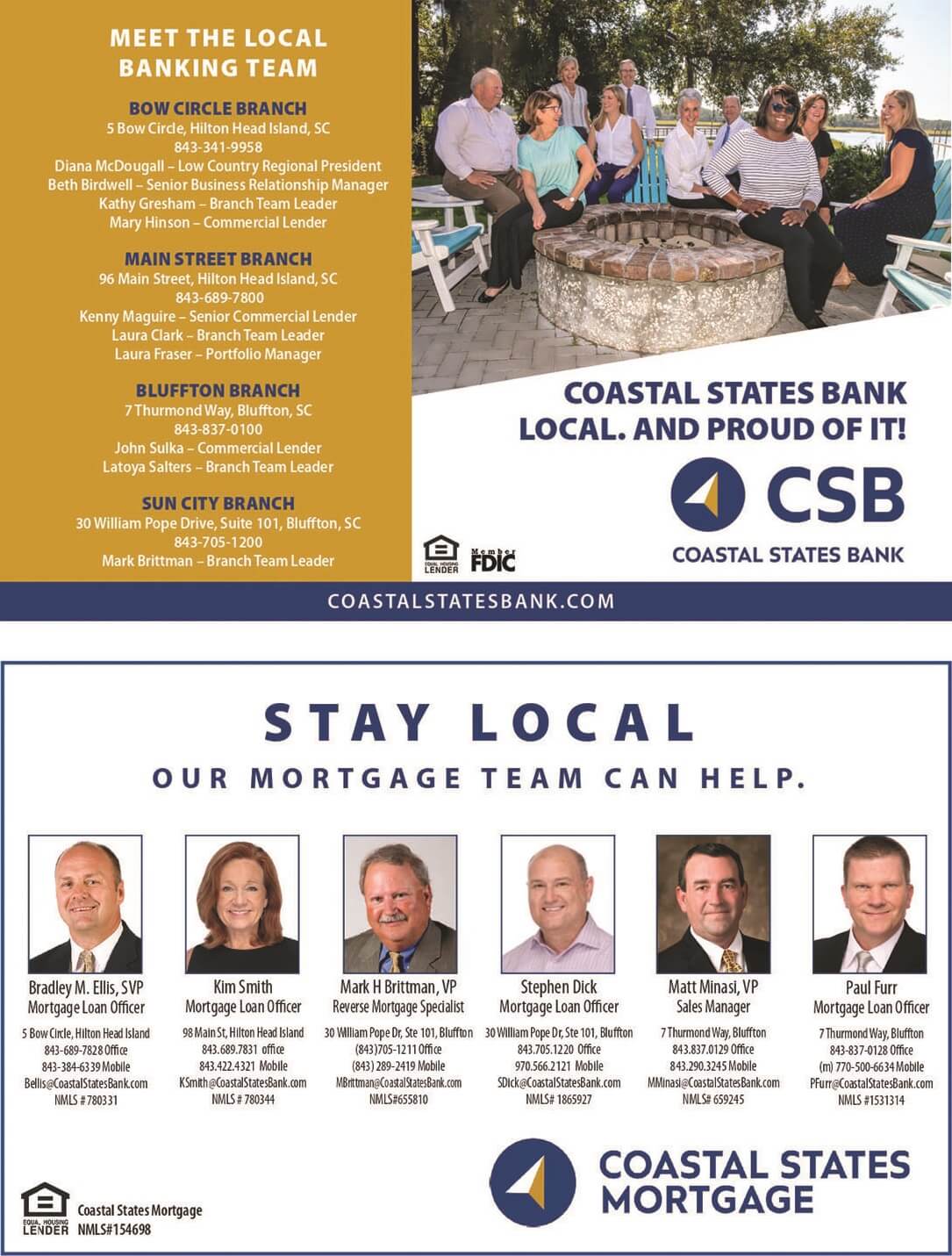

For more information contact: Mark Brittman (NMLS ID#655810) has 40 years’ experience in the banking industry and is a seasoned residential lender. Mark manages the Sun City Location for Coastal States Bank and originates Reverse Mortgages. Reach out today by email at: mbrittman@coastalstatesbank.com, by phone at 843-705-1211, or in person at 30 William Pope Drive, Suite 101, Bluffton. Member FDIC. Equal Housing Lender.

Provided by Mark Brittman, Reverse Mortgage Specialist, Coastal States Bank